Frequently Unasked Questions About The Budget

Why is the mayor smiling?

Every year since he took office in 2002, Mayor Michael Bloomberg has faced a budget deficit, and responded by cutting libraries, closing firehouses, and raising taxes. Now the city is expecting to end this fiscal year (on June 30) with a $3.3 billion surplus - one of the largest surpluses in city history, even bigger than the ones Giuliani had during the dot-com boom years.

"We have a reason to have a grin on our face," said Bloomberg.

Should the average New Yorker be smiling?

It depends. Using the budget surplus of $3.3 billion from this year, Mayor Bloomberg is trying to give nearly everyone in the city something to be happy about in his proposed budget, called the Executive Budget, for fiscal year 2006, which begins on July 1, 2005. No mayor has ever tried to spend so much surplus money in a single year, according to Elizabeth Lynam of the Citizens Budget Commission.

The mayor and the City Council must agree on the details of this budget by June 30.

What is he proposing?

The mayor is proposing $500 million worth of tax cuts. He will ask the State Legislature in Albany to cut the sales tax on clothing and shoes under $110 from 8 to 4 percent. Bloomberg is also giving a $400 rebate to those who own a home, co-op, or condo, just as he did last year.

In contrast to previous years, when he proposed cutting senior citizen programs, the mayor wants to spend $17 million more on senior centers and meal delivery programs. Instead of threatening to close zoos, as he did in the past, he is proposing money to renovate them.

The mayor's 2006 budget (which begins July 1, 2005) would:

- Increase the city's education budget by $800 million, with new money for class reduction and intervention for struggling students, and expanded advanced-placement programs.

- Provide money to renovate 125 firehouses and six police stations

- Institute more frequent trash collections

- Resurface 8,000 miles of city streets

- Construct 10,000 homes and preserve 5,000 more

- Allocate $21 million more for summer youth job programs

- Give libraries a $7 million increase

- Give $27 million to Lincoln Center for redevelopment projects, $25 million to the Queens Museum to expand and $21 million to the American Museum of Natural History for improvements "in the Genomic and Ornithology Departments."

- Provide $12.5 million in tax incentives for film production and $130 million for the development of the Greenpoint/Williamsburg waterfront

- Renovate hospitals, parks, and museums.

Why does the city have a surplus when a few years ago it had a $6 billion deficit?

The economy has improved and tax revenues are higher than expected.

The city's economy has recovered from the downturn that occurred after the terrorist attacks of September 11, 2001. Wall Street profits, which account for about a third of the city's tax revenue, brought in twice as much to the city's coffers in 2005 as in 2002.

The real estate market is strong, and the city charges a transaction tax every time a property is sold or refinanced.

And the increases in the personal income tax, sales tax, and property tax that Mayor Bloomberg instituted in 2002 and 2003 have also generated a large windfall of money.

Who's not smiling?

Two groups -- fiscal watchdogs and city workers -- are not happy.

Why aren't fiscal experts happy?

Many budget experts argue that the mayor is thinking more about the election in November than about future deficits.

"Taking a $3.3 billion surplus and spending it all next year is pretty short-sighted," said Charles Brecher of the Citizens Budget Commission. "To have a surplus of that size and not use a penny of it to pay off debt... it's a spending spree."

By next year, all of the surplus will be gone.

In fiscal year 2007 (which begins July 2006), the city expects to have a $4.5 billion deficit. In fiscal year 2008, the mayor projects a $4.2 billion deficit.

Why aren't unions happy?

Teachers, police officers, firefighters, and other city workers - who are all seeking new contracts and raises - say the mayor is leaving them out of the budget.

"Their priorities are out of whack," said Randi Weingarten of the United Federation of Teachers. "This is the largest surplus ever. Yet, there is not a single penny for teachers, police officers, firefighters or other municipal workers."

To the unions, the mayor replied, "We don't have the money."

Why does the mayor say he doesn't have the money for unions?

The Bloomberg administration reportedly offered the teachers, police officers, and firefighters a five percent wage increase over three years - the same amount he gave to District Council 37 city employees last year - which city officials estimate would cost the city $650 million a year. (Officials also asked for work concessions.)

The unions representing teachers, firefighters, and police rejected the mayor's offer as inadequate to keep and attract employees when they can earn so much more in the surrounding suburbs.

Rather than using the surplus for larger pay raises, Bloomberg plans to give some of the money back to taxpayers.

The mayor wants to repeal the city's sales tax on clothing, which will cost $256 million a year. The property tax rebate costs $230 million a year. And the personal income tax surcharge for individuals earning more than $100,000 - which generates about $600 million a year for the city - is set to expire.

Even though the mayor isn't giving city workers raises, the city's labor costs are rising by 20 percent.

Pension costs are the fastest growing share of the budget. According to the mayor's office, pension and fringe benefit costs rise five percent each year; by the year 2008, the city will pay $10 billion a year in pensions or about 20 percent of the annual budget. The state, not the city, controls pensions.

Other costs are rising as well.

Unlike most other cities in the nation, New York City is required to pay a portion of the state's Medicaid costs.

Where does the mayor get these budget numbers?

Projecting future revenues and expenses is not an exact science. The city uses a variety of economic models to try to predict what will happen, but politics also come into play.

The City Council complains that the mayor purposely underestimates tax revenue, because the mayor doesn't want the city's budget situation to look too rosy, or the state and federal government will be less likely to send aid.

The budget is also negotiated and modified throughout the fiscal year, which begins July 1.

In the fall, city agencies, after consulting with community boards, submit their budget requests. In January, the mayor releases what is called the Preliminary Budget, which shows how much the city expects to spend and projects how much tax revenue will come in each month. The community boards, borough presidents, and the City Council all make recommendations.

In the spring, the mayor presents a revised budget, called the Executive Budget. The mayor then negotiates the details with the City Council, a frequently contentious and theatrical process.

Both sides must reach an agreement for a balanced budget by June 30.

How will the next mayor deal with the future deficits?

How will the next mayor deal with the future deficits?

Mayor Bloomberg's "good news" budget was difficult for his political opponents to criticize, but they all said they would do something differently if elected in November.

C. Virginia Fields did not issue an official response to the mayor's budget, but she has said, if elected, she would give city workers raises.

Anthony Weiner said he would institute a tax on people making more than $500,000 a year.

Fernando Ferrer criticized the mayor for allowing lawmakers in Albany to postpone action on the Campaign for Fiscal Equity lawsuit, which requires an increase in funding for education. He has called for a tax on Wall Street to help fund education.

City Council Speaker Gifford Miller took credit for the decrease in the sales tax, which the City Council has proposed in previous years. He believes that the personal income tax surcharge on people who make more than $500,000 a year should continue.

Bloomberg wouldn't even try to explain how the next mayor -- whether it is himself or someone else -- should address the future deficits.

"I do not have a good answer for you on how we are going to come up with an extra $4.5 billion," he said.

Related Articles:

State Budget, On Time But Imperfect. Also ' City Budget; City Performance

Caution: Budget Pitfalls Ahead

Related: |

Thanks to a higher-than-expected wave of tax revenues, Mayor Michael Bloomberg last week presented an executive budget that reduces some taxes and reverses some spending cuts that he had proposed earlier. He is able to do this, he says, because there is now an estimated $3.3 billion surplus for the current fiscal year, which began in July 2004.

But the mayor does not use this record surplus to launch expensive new programs or propose big tax cuts--certainly temptations in an election year.

There are good reasons for the mayor's caution. The budget plan projects that the following fiscal year, beginning in July 2006, will have a gap of $4.5 billion.

The mayor and City Council have tamped down growth in spending on most city services, such as police, sanitation, and programs for seniors. But other expenditures have grown significantly and some are likely to continue to grow: Medicaid, debt service, and pensions and other fringe benefits for city employees. The mayor often calls these items nondiscretionary or uncontrollable costs. He is right -- to a point.

In the near term, there is not much the city can do to ease expenditures on these items. This spending is locked in by law, prior commitments, or collective bargaining. So the fixes cannot be quick or unilateral. But, while the city has taken some steps, unless it increases its work on bringing these costs down, makes very large cuts to other programs and services, or finds new or unexpected revenue, we could soon find ourselves in deep trouble. Here are the pitfalls ahead.

MEDICAID

The mayor expects this health-care program for low-income people to cost the city $4.9 billion this year and $5.5 billion by 2009. Decisions about Medicaid spending are made in Washington and Albany, not City Hall. The recently adopted state budget offers some relief by capping the rate of growth in city spending on Medicaid. But that assumes the state will be able to pick up a larger portion of the tab, an assumption that could fall victim to the state's own fiscal problems. Even if the assumption holds, New York City must still shoulder a far bigger share of Medicaid costs than other cities around the country.

To lower the Medicaid burden, some people have suggested that the city be less active in helping people to enroll in the program. But this could result in more uninsured New Yorkers using the city's public hospitals. Last year, the public hospitals provided about $200 million of unreimbursed care for the uninsured, part of the reason the system is facing its own budget shortfalls and the mayor and the City Council decided to increase the city subsidy to the hospitals.

PENSION PROGRAMS

The city's ability to rein in pension costs for its employees is also complicated. The mayor projects that the city's contribution to pension costs will jump from $3.4 billion this year to $5.0 billion in 2007, before declining as the funds' strong investment gains in 2004 are phased in. The city will still be spending more long term because of decisions made in Albany, such as providing a cost-of-living adjustment for retirees, and demographic changes, such as longer life spans. One way to ease future pension costs is to move from a pension plan where people are guaranteed a certain benefit to one, resembling a 401K, where they make a set contribution but are not promised a guaranteed benefit amount when they retire. But again, that is not just up to the mayor, the unions must agree as well.

EMPLOYEE FRINGE BENEFITS

The mayor anticipates that the costs of fringe benefits for city employees will grow steadily from $5.2 billion in 2005 to $6.5 billion in 2009. Some have proposed that city workers make larger co-payments to their health plans as a way to rein in the cost of benefits to the public. Here, too, the decision is not the mayor's alone. The unions must also agree.

DEBT

Of all these growing spending items, debt service costs may be most under the city's direct control. But even here, fixes take time and may make matters worse in the short run. The mayor estimates that debt service—the payment of interest and principal on the funds the city borrows to build or repair its infrastructure—will rise from $3.3 billion this year to $4.9 billion by 2009.

While the city cannot undo its obligations from prior borrowing (and further opportunities for refinancing are limited), it can borrow less in the future. But this is easier said than done considering the city's needs for new schools, road and bridge repairs, and the like. The city could also eliminate what some might describe as discretionary capital spending on cultural institutions, stadiums, and so forth. Additionally, the city could forgo some borrowing and undertake more capital projects on a pay as you go basis, although this approach reduces the funding available for general operating expenses.

CONTRACTS AND SCHOOLS

At least two other potentially hefty costs lurk on the not-too-distant horizon. Police, fire, sanitation, and corrections officers, along with teachers, continue to work with expired contracts, and pacts with the rest of the city's unions begin to run out this June. Although the budget includes some funds set aside in anticipation of the settlement of these contracts, agreements will likely come at a higher cost.

The eventual resolution of the Campaign for Fiscal Equity lawsuit on school funding also continues to pose risks for the city's budget balance. With Governor George Pataki's decision to appeal the lower court ruling, a settlement is unlikely until at least next year. But the ultimate costs to the city could be large given that a court-appointed panel determined that spending should increase over four years so that it will be $5.6 billion higher (adjusted for inflation) than in the current year. If the city were required to fund one-quarter of that increase, as in an example presented by CFE, the city's share could eventually be over $1 billion annually.

Given the high and growing costs to the city for Medicaid, debt service, and pensions and fringe benefits for city workers along with potential new costs from labor and CFE settlements, there are ample reasons for the mayor's cautious approach to the 2006 budget. This year's large surplus does not guarantee that balancing the city's budget in future years will be easy.

Doug Turetsky is chief of staff and communications director of the New York City Independent Budget Office.

The Mayor's Budget Has No Big Ideas; The Council's Does

Mayor Michael Bloomberg’s $50 billion executive budgetfor fiscal year 2006 marks yet another skillfully crafted short-term financial plan. Its most notable feature is the carry-over of a $3.3 billion surplus from this year’s budget, which provides a very nice one-time boost for an election year. One can wonder how the revenue projections by the city’s fiscal experts could have been off by so much ($1.3 billion of it in just the last three months!), but the more interesting question is why, even with such a huge dividend, there is not a single Big Idea in the mayor’s budget.

One simple answer is that in an election year, the idea is to please as many people as possible, and that leads to spreading the wealth broadly, and thinly. Indeed, the mayor’s press release is a four-page listing of small initiatives and restorations in areas from education and public safety to health, parks, libraries and welfare. But the best the mayor can do in the expense budget is a $50 million initiative in education, which represents about half of one percent of city education spending.

The small vision in the executive budget is underscored by the little-noticed, but much more inclusive and ambitious, budget plan (in pdf format) that the City Council released a month ago. The council has its own list of small restorations and initiatives, but it also has several larger ideas:

Council’s Tax Proposals

The council tax plan is in marked contrast to that of the Bloomberg plan, which for individuals has just two parts: the $400 rebate for homeowners, and a city sales tax exemption for clothing under $110 (which averages out to about $28 per person). The council’s plan has several parts. It would double the earned income tax credit (EITC) for lower-income wage earners; some 700,000 households would receive up to $430 apiece. It proposes an expanded State Tax Relief (STAR) program that would enhance senior benefits and include tax relief (currently available only to homeowners) to some 150,000 renter households with children.

Commuter Tax

The Council re-states the argument for the city commuter tax that Governor George Pataki and the state legislature eliminated in 1999, but with a twist. Given the MTA’s financial struggles, especially on the capital side, the Council argues for a $1.1 billion tax (only one percent) that would be dedicated to the MTA capital program. This let’s-share-the-burden rationale is a refreshing perspective.

Taxing Insurance Companies

Another refreshing idea is to tax the 800 insurance companies in the city that, unlike all other general corporations, are exempt from the general corporation tax. The proposal would tax all but their health-insurance business, and would raise about $200 million over a full year.

Although the new revenues generated from the insurance companies could, of course, be used for other purposes, the Council would use them to pay for an across-the-board five percent cut in the corporation, banking, and unincorporated taxes. Benefits in the form of personal income tax credits ($40 million) would also go to resident shareholders in S-Corporations, which are mostly small businesses.

Rainy Day Fund

The Council tackles another important area untouched by the mayor: the possibility of some kind of “rainy day” or budget stabilization fund. Such a fund could give the city more flexibility with budget surpluses. Currently, a mayor must spend any surplus before the end of the fiscal year. He can’t park it, say, for use in tough economic times.

Thus Mayor Bloomberg must pre-pay some of next year’s bills with this year’s projected $3.3 billion surplus. (The fund might also temper the habit of mayors like Bloomberg and Rudy Giuliani to use surpluses as convenient one-shot revenues sources, preventing long-term structural budget balance.)

The council asks that the state authorize use of a rainy day fund, to be funded in good economic times (when, say, tax revenues exceed adopted budget projections by seven percent), and to be tapped only when revenues decrease. This would permit setting aside excess revenues over several fiscal years.

Improving Accountability

Another, more technical area of importance that the mayor ignores is the question of “units of appropriation.” So-called “U/A’s” are city charter mandated categories of spending that are supposed to permit the council and others to monitor city spending, but the council has long complained that the units are so big that they make monitoring all but impossible. This is an accountability issue that might well be suited for the current city charter revision commission, and it is good to see the council raising it.

Hiring More Cops

On the expense side of the budget, the council would add 1,000 cops. The council points out that, although the total number of officers has been reduced from over 40,000 to 37,000 in recent years, there hasn’t really been any budget saving because of associated increased overtime. Thus adding the new officers could be paid for by simply reducing overtime.

Small Vision

The council, like the mayor, has abandoned some other Big Ideas. For instance both sides of City Hall have chosen to let “sunset” (end) both the temporary personal income tax surcharges (on the wealthiest New Yorkers) and the sales tax increase; this means, by 2007, a loss of some billion dollars in revenues. Quiet decisions like this help keep future budget deficits high. (The mayor estimates deficits from $3.7 to $4.5 billion a year from 2007 to 2009). And neither the council nor the mayor has accepted the responsibility of contributing to the very big increase in school funding ordered by the state courts in the Campaign for Fiscal Equity case.

But the council has at least kept important ideas like tax fairness, accountability, sacrifice, transparency, and long-term fiscal stability alive in an otherwise lackluster budget debate. Whether or not they will work their way into the 2006 budget, the city’s future depends on them.

Glenn Pasanen, former associate director of City Project, teaches political science at Lehman College of the City University.

Bankruptcy "Reform"

Going broke follows much the same rules as winning the lottery — which is to say, the rules of chance.

Bankruptcy “reform,” on the other hand, much like welfare “reform,” assumes that people who benefit from the existing system just need a little tough love to force them to take financial responsibility for their own lives. Accordingly, the bankruptcy bill now making its way through Congress makes it harder for middle-class people to make a fresh start after declaring bankruptcy, because they will have to pay back more of their creditors.

Who declares bankruptcy?

About half of all debtors file bankruptcy because of medical bills, even though three-quarters have health insurance during all or part of their illness. Many lose coverage as a result of losing their jobs. Three out of five can’t afford to visit a doctor or dentist when they needed to, at least once during the two years before filing for bankruptcy. Almost 40 percent of patients with terminal illnesses report having to cope with financial problems as they prepare to die.

There are big gaps in the patchwork of income supports available when you can’t work because of illness or disability. Worker’s compensation doesn’t cover all employees, and only applies to conditions caused by work itself. State disability payments don’t cover all employees either, and they only last for six months. You can’t get federal disability payments until you’ve lost a year’s income, and even then, you must be facing death or another year away from work in order to qualify for benefits. The Family and Medical Leave Act allows many workers to retain health coverage while they care for sick family members, but it doesn’t provide any income.

The American Bankruptcy Institute estimates that fewer than four percent of filings are by people who could actually pay their debts. Many debtors put off declaring bankruptcy until they have lost their telephone service (40 percent), gone without necessary medicine (43 percent), or been too poor to buy food (19 percent) at least once.

Children are a big risk factor for insolvency: married couples with children and single mothers are two and three times more likely to go bankrupt, respectively, than their childless counterparts. Divorced mothers face an additional risk, because they often lose health coverage linked to their ex-husbands’ jobs.

The Effect On New York City

New York residents will be hit especially hard if the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 becomes law:

The number of personal bankruptcies is going up faster in New York City (8.4 percent in 2003) than nationwide (5.6 percent). During 2004, there were about 76,000 filings for personal bankruptcy in New York State.

New Yorkers face greater financial challenges than the average American. Prices are rising faster in the city than nationwide, due to large increases in the cost of housing, food, and transportation. In 2003, local salaries dropped by 1.6 percent, when adjusted for inflation.

The new law would eliminate important protections for debtors whose landlords are evicting them for back rent.

Personal Bankruptcy Before “Reform”

Bankruptcy itself is not a financial disaster. It protects filers from collection agents, “repo men”, and other consequences of an overwhelming level of debt.

In 2004, four out of five personal bankruptcies were filed under “Chapter 7,” which allows all debts to be cancelled except for student loans, overdue tax payments, child support, and alimony. Debtors must sell any available assets to pay their bills before debts are written off, but 96 percent of them have nothing to sell.

Under “Chapter 13,” the bankrupt person or family must follow a court-approved repayment plan under which all available income is paid to creditors for three to five years. In practice, two-thirds of them never finish the repayment plan. Some are allowed to change over to Chapter 7 status, if it becomes clear that repayment is impossible for them. Others lose the protection of bankruptcy and have to deal directly with creditors again, with additional interest on their debts for the time they were in bankruptcy.

Under both Chapters 7 and 13, debtors must keep up-to-date on payments for loans backed by houses, cars, or other assets, or those items will be repossessed by the creditor.

Changes Under The Proposed Bankruptcy Bill

The biggest change would be that people who earn more than their state’s average income might not be allowed to file for Chapter 7, regardless of their actual expenses. The Internal Revenue Service sets annual guidelines for how much money a household needs for such essentials as food and housing; any income beyond those levels would be considered available for paying creditors. Judges would no longer be able to take individual circumstances into account, as they do now.

The poorest debtors would not be affected by this change. Many don’t file for bankruptcy, as they have no assets to lose. Those who do file would still be eligible for Chapter 7 status. Wealthy debtors retain major loopholes under the new bill, such as the right to keep valuable homes and retain assets in special trusts.

The changes would fall squarely on the shoulders of middle-class people facing life crises like illness, disability, unemployment, divorce, and death in the family. Democratic members of Congress unsuccessfully introduced dozens of amendments that would have helped consumers and debtors, including specific protections for the elderly, veterans, and caregivers to sick or disabled family members.

Some single parents who manage to avoid bankruptcy themselves would have a harder time collecting child support and alimony. When noncustodial parents are forced to declare bankruptcy under Chapter 13, rather than Chapter 7, the repayment plan diverts some of their limited income from child support and alimony to credit card debts.

Legal fees would probably rise sharply under the proposed bill, which would hold attorneys responsible if their clients filed bankruptcy petitions with missing or incorrect information. This would lead to more paperwork and higher malpractice premiums. In addition, more bankruptcy court judges would be needed, so the bill raises court fees to pay their salaries.

Never A Free Ride, Soon To Be Worse

While bankruptcy can free debtors from their worst predicaments, it has never been a comfortable safety net. A stigma of failure and irresponsibility surrounds it. Credit reports list bankruptcy for up to ten years, a problem even for those who have no interest in new borrowing. After bankruptcy, insurance premiums are often raised, as well as interest rates on new or remaining debt. An increasing number of landlords and employers are checking credit reports as part of the application process.

One year after they file for bankruptcy, half of all filers report that they are no better off financially. The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 would prolong their troubles, and ensure that more filers get less protection from the law.

Linda Ostreicher, a former budget analyst for the New York City Council, is a freelance writer and consultant to nonprofits.Â

State Budget, On Time But Imperfect. Also -- City Budget; City Performance

For elected officials who tend to look at budgets one year at a time, the news lately has been very encouraging, especially in an election year. The state budget was passed by the deadline for the first time in 21 years! Three separate fiscal monitors are optimistic about the city’s finances, and the Independent Budget Office predicts a $2.5 billion surplus by June, some $500 million more than the mayor projected two months ago.

But let’s take a closer look.

The State Budget

The new state budgetpassed by the legislature (the governor may still veto parts of it) may be on time, but it does little to help the city’s long-term prospects. Worse, it has several regressive components. The big blow is that state education aid to the city will grow only by $325 million next year, in the face of the state Court of Appeals’ order in the Campaign for Fiscal Equity case to add $1.4 billion.

On the tax side, the little guy gets hit the hardest. The temporary state sales tax increase set two years ago was allowed to sunset on schedule in May. But in an all-too-familiar, last-minute deal, the Metropolitan Transportation Authority share of the sales tax (0.25 percent) was increased to 0.375 percent (The total city/state/MTA sales tax, if the city lets its increase sunset, will be 8.375 percent.)

This adds insult to injury. On top of the apparent bargain-rate sale by the MTA to the Jets and the recent fare increases, city residents (and residents of metropolitan counties) will now pay the MTA some $250 million more next year. For car owners, fees will go up by $180 million.

Then there is the broken promise of a tax cut that would help lower-income residents. The scheduled restoration of the sales tax exemption on clothing costing less than $110 was killed, making the sales tax even more regressive. At the same time, the promise to sunset the progressive state personal income tax increases was kept -- a $1 billion benefit to the state’ s wealthiest residents.

The City’s Preliminary Budget

Several new fiscal reports describe what could be called a city financial plan on automatic pilot. Mandated city expenses – Medicaid, pensions, health benefits, and debt service – increase substantially over four years. Projections for everything else -- the discretionary programs ordinarily adjusted one way or another each year -- are pretty much flat. There is no vision, no sense of priorities in the plan. Further, flat spending on city services, adjusted for inflation, translates into a long-term cut in actual dollars and, presumably, services.

But three fiscal monitors do share short-term optimism about the city’s fiscal condition. A report(in pdf format) by the state comptroller says, “Fortunately, the budget has benefited for the second year in a row from an unexpected surge in tax revenue.” (Last year the surge came from Wall Street revenues; this year it is real estate transactions.)

With this year’s budget surplus used to help balance next year’s budget, the state comptroller sees the 2006 risks as “manageable for this point in the financial planning process.” Similarly, a report(in pdf format) by the city comptroller says the 2006 budget “appears on course toward balance assuming the risks it contains are expeditiously addressed.” The big risk is the “ambitious” assumption of $750 million in budget relief from state and federal governments.

A state financial control report(in pdf format), like the two others, focuses on the structural problem: Fringe benefits, pensions, Medicaid, and debt service are “projected to rise at a pace that outstrips the growth in tax revenues.” Other risks include the court-mandated education spending ignored in the new state budget and uncertainty about future labor settlements.

The city comptroller adds a worry about the Health and Hospitals Corporation, which, he says, faces budget gaps ranging from $485 million to $636 million in fiscal years 2006 to 2009. Those gaps might require the city to increase its recent $150 million subsidy to the corporation.

Building Better Measurements Of Management Performance

The Independent Budget Office (Analysis of the Mayor's Preliminary Budget for 2006 and Financial Plan through 2009) paints an optimistic picture. It projects that this fiscal year’s tax revenues will be $1.5 billion higher than last June’s adopted budget claimed, helping boost the 2005 surplus to $2.5 billion. Looking further ahead, the IBO projects 2008 and 2009 deficits to $3.0 billion and $2.2 billion, respectively, much lower than earlier estimates.

This brightening picture unfolds even though tax revenues in 2006 will actually decline by more than $140 million, primarily because of lower property-related taxes and the sunset of the city’s own temporary personal income and sales tax increases from 2003.

But the report also reveals a curious loss of revenue – and one which adds to the inequality of the city’s bizarre property tax system (discussed in earlier Finance topic page articles) while giving a benefit to a relatively few homeowners. Next year, the city will (assuming the property tax rate remains the same) lose $31 million in tax levy from a new assessment process affecting one-, two-, and three-family homes.

The benefit (in addition to the $400 homeowner rebate set for next year) goes to some 50,000 owners, who will get an average savings of $775, while the other 630,000 owners will actually pay about $60 more on average.

What’s most interesting about the IBO’s 154-page report, however, is its new focus on program budgeting, which will assist researchers looking at city management issues. Program budgeting differs from the mayor’s “units of appropriation” budgeting (which lump dollars into large categories like “personal service” (PS) and other-than-personal-service (OTPS)). The IBO use of program data numbers is to “link budgetary resources to the results produced,” a tool, in other words, to measure accountability.

For example, the Preliminary Mayor’s Management Report (Preliminary Fiscal 2005 Mayor's Management Report (PMMR)), released in February, lists the Department of Education’s $13.7 billion in 2005 expenditures on one line only. (The city charter’ section 12(In PDF format) says the Preliminary Mayor’s Management Report should link such numbers to program goals and results, but in practice it does not do that in a way that measures performance.)

The IBO report, in contrast, lists four program areas of education expenditures -- instruction ($10.3 billion in 2005), administration ($629 million), non-instructional support ($2.0 billion), and non-public school payments ($812 million) -- over five years.

Instruction dollars, it turns out, are up 24 percent over the past four years, and non-public school payments are up 46 percent over the same period.

For the Administration for Children’s Services, the Preliminary Mayor’s Management Report lists one-line expenditures of $2.1 billion in 2005. The IBO breaks that into nine program areas, from child care ($478 million in 2005) and Head Start ($152 million) to adoption ($326 million) and foster care ($802 million). That breakdown then allows the IBO to analyze shifts in spending among the program areas in an agency undergoing major adjustments in its in-house and contracting services.

This is only a first step --“ more program lines would be better -- but with a city financial plan on automatic pilot and mayor’s management reports that dodge their accountability mandate, this IBO innovation provides a useful starting point for measuring administrative performance.

Glenn Pasanen, former associate director of City Project, teaches political science at Lehman College of the City University.

NYC Jobs: A History

Working in New York: A Timeline

BEGINNING TO 1843: TRADE

1625: Early Business

The Dutch West India Company’s trading post at the southern end of Manhattan is named New Amsterdam.

1670: Early Commerce

The royal governor of New York organizes the colony’s first merchants’ exchange where craftsmen, importers and merchants conduct business for an hour every week.

1691: Government Regulation

The city establishes rules governing the carting business, including fees, size of loads and who can own carts.

1768: Business Group

Twenty merchants organize the New York Chamber of Commerce in a meeting at Fraunces Tavern.

1792: Trading Shares

1792: Trading Shares

The New York Stock Exchange has its beginnings as 21 brokers sign an agreement under a buttonwood tree on Wall Street. In the pact, they agree to rules of conduct and set commissions.

1835: Great Fire

Fires in the Wall Street area level much of the city’s financial district, so that banks and insurance companies cannot make payments. The Common Council, a precursor of City Council, only authorizes $6 million in loans. In the ensuring financial chaos, banks and insurance companies fail and prices rise sharply.

1844 TO 1945: RETAIL AND MANUFACTURING

1877: Beginnings of the AFL

1877: Beginnings of the AFL

New York cigar maker Samuel Gompersreorganizes the Cigarmakers Union, setting up an international union and establishing dues to pay for strike funds and pensions. In 1886, Gompers will form the American Federation of Labor, which he will head for most of the following 40 years.

1899: Safer Factories

The New York State Legislature passes the Costello Anti-Sweatshop Act, which regulates work done in city tenements. It also passes measures to increase worker safety laws and limits working hours for women and children.

1900: The Union Label

The International Ladies’ Garment Workers Union, representing workers in Newark, Philadelphia and Baltimore as well as New York City, is founded on the Lower East Side.

1909: On the Picket Line

As 20,000 working women, members of Ladies Waist Makers Union Local 25, go out on strike, rich women’s suffragists join the young immigrant women to push for better pay and working conditions. The workers will return to their jobs after nine weeks, having won higher wages and a 52-hour work week.

1910: Help for the Hurt

The state legislature establishes a worker’s compensation system to insure workers who are injured on the jobs and to provide incentives for employers to improve job safety.

1911: Triangle Tragedy

A four-alarm fire sweeps through the Triangle Shirtwaist Factory on Washington Place, killing 146 people, most of them young women. There is no sprinkler system in the factory, fire department ladders are too short to reach the blaze, and the owners have locked all the exists to the factory to prevent theft, leading the workers to leap from the factory. The fire prompts new demands for safer conditions in factories, but the factory owners will be acquitted on al manslaughter charges related to the fire.

1911: Shorter Hours

The state legislature passes a law limiting the number of hours women can work per week in a factory to 54.

1913: Bank Regulation

President Woodrow Wilson signs a law establishing the Federal Reserve System to regulate U.S. banking and currency. It established 12 Federal Reserve Banks, including one in New York City.

1916: Child Workers

1916: Child Workers

In an effort to control child labor, Congress passes the Keating-Owen Act, which bans interstate transportation of products made in factories, shops, canneries or mines employing children. In 1918 the Supreme Court will rule the act unconstitutional.

1925: A New Union

A. Phillip Randolph, publisher of the “Messenger,” a New York monthly on black politics and culture, organizes the Brotherhood of Sleeping Car Porters in Harlem.

1933: New York Woman

President Franklin Roosevelt names Frances Perkinsof the Consumers League of New York as his labor secretary. The first woman Cabinet member ever, she will serve at a time when government involvement in labor issues increases dramatically. In the same year, Roosevelt established the National Labor Board to insure worker’s rights to collective bargaining. It will be chaired by New York Senator Robert F. Wagner.

President Franklin Roosevelt names Frances Perkinsof the Consumers League of New York as his labor secretary. The first woman Cabinet member ever, she will serve at a time when government involvement in labor issues increases dramatically. In the same year, Roosevelt established the National Labor Board to insure worker’s rights to collective bargaining. It will be chaired by New York Senator Robert F. Wagner.

1935: National Labor Law

Congress approves President Roosevelt’s plan to create a Social Security program to provide benefits to the retired and the unemployed. It would be financed by a payroll tax on current workers’ wages. Congress also passes the Wagner Act, introduced by Senator Robert Wagner of New York, guaranteeing workers the right to collective bargaining and establishing other rights for labor unions and their members.

1938: Regulating Work

Congress passes the Fair Labor Standards Act, putting limits on the length of the work week, requiring overtime pay and setting a minimum wage of 25 cents an hours for most workers. For the first time, federal law will set a minimum age for employment and limit the number of hours that children can work.

1945 TO TODAY: BUSINESS AND FINANCE

1958: Unions for City Workers

1958: Unions for City Workers

Mayor Robert Wagner, son of the pro labor senator, signs an executive order giving municipal employees the right to collective bargaining with the city.

1964: Equal Rights

Congress passes the Civil Rights Act, which prohibits discrimination in employment based on race, color, religion, sex or national origin.

1967: Staying on the Job

Following several strikes by public employees, including a transit strike the year before, New York State passes the Taylor Act, which allows government employees in the state to form unions and negotiate contracts but bars most public employees from going out on strike.

1968: City Projects

The state legislature creates the Urban Development Corporation, a public authority to initiate, finance, build and manage projects in the state. Although in its early years, it will concentrate largely on housing, it will turn increasingly to aiding economic development projects, such as the South Street Seaport and the Marriott-Marquis Hotel.

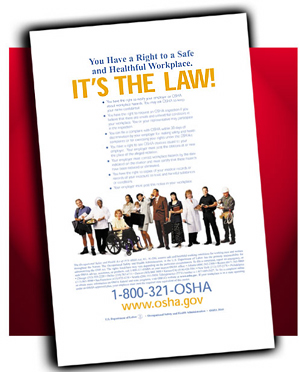

1970: Cleaning Up Factories

1970: Cleaning Up Factories

Congress passes the Occupational Safety and Health Act setting regulations for safety in the workplace and establishing an agency to enforce them.

1986: Special Districts

New York State establishes the Empire Zones program to attract companies to blighted areas throughout the state, including New York City, with lower taxes, worker-training programs and low-interest loans.

1993: Trade Agreement

Congress, with strong backing from President Bill Clinton, approves the North American Free Trade agreement, which establishes a free trade zone encompassing Mexico, Canada and the U.S. Proponents say it will create jobs and help consumers, while opponents say it will undercut wages for U.S. workers, encourage businesses to move jobs to Mexico and erode environmental and workplace safety protection.

1997: New York Sweatshops.

1997: New York Sweatshops.

In the first such survey ever taken by the federal government, investigators find that 59 percent of a randomly selected sample of New York garment factories violate overtime laws and pay employees less than the minimum wage. Some of these factories provide merchandise for chain stores, such as Wal-Mart, Kmart and Nordstrom.

1999: Town/Gown

The New York State legislature and Governor George Pataki create the NYSTAR program to encourage the state’s research universities and institutions to invest in technologies that will create jobs in cutting edge industries.

2002: Enough to Live On

City Council passes a living wage bill raising the pay of 50,000 home health care attendants to $8.10 an hour with benefits (about 60 cents above the current average), or $9.60 an hour without benefits.

2002: Economic Boost

Congress passes The Job Creation and Worker Assistance Act of 2002 that extends the amount of time workers can receive unemployment benefits from 26 to 39 weeks and provides tax breaks for businesses to encourage them to expand and create more jobs.

2004: Minimum Wage Dispute

Over Governor George Pataki’s objections, the state legislature agrees to increase the minimum wage in the state to $7.15 an hour by 2007 (the federal minimum wage is $5.15 an hour).Â

State Debt + Federal Debt = City Budget Trouble

Mayor Michael Bloomberg's preliminary budgetfor fiscal year 2006 should, as promised, translate into a balanced adopted budget in June with a minimum of fuss. The details of that election-year budget will likely change in several ways, but with the surplus for this year already at $1.4 billion - and likely to rise - there is plenty of room for last-minute adjustments to get the mayor and city council through their skirmishes over the mayor's annual cuts in health, social, cultural, youth, senior, and other human services.

What's not promised is longer-term budget balance. The mayor's proposed actions for 2006 - detailed in Gotham Gazette's recent report-- do next to nothing about future deficits. For instance, the city deficit for fiscal 2008, as of last June, was projected to be $3.7 billion; now it is projected to be $3.6 billion - not counting many risks, such as unrealistic labor-cost projections.

The biggest change likely to take place before June's budget adoption is a reduction in the mayor's wish list for $750 million in new federal and state aid. One reason why is illustrated in two new reports on federal and New York state budgeting. They show how federal deficit spending - borrowing money to pay current expenses - and state borrowing increase budget gaps and diminish prospects for new intergovernmental aid.

According to a January report from Citizens for Tax Justice (In PDF format), extraordinary levels of federal deficit spending will dramatically increase federal debt service payments and likely force cutbacks in discretionary spending. At the state level, State Comptroller Alan Hevesi's new report on state debtunderscores how Governor George Pataki's borrowings in the past four years have added billions of dollars of new state debt.

Federal Deficit Spending

Citizens for Tax Justice's report is entitled, "Bush's $10 Trillion Borrowing Binge: An Update." It is a blow to prospects for any new federal aid to New York in the near future. Using "frightening statistics" from the respected Congressional Budget Office's January report on the federal budget and economy, Citizens for Tax Justice shows how projected annual deficits under Bush policies "skyrocket" from $572 billion in 2005 to $1.164 trillion by 2015.

These new projections for 2015 are seven times what the president projects, because the current Bush numbers assume, among other things, that current tax cuts "sunset,' that Iraq and Afghanistan expenditures will suddenly end, and that federal appropriations will "plummet" as a share of the economy. The Congressional Budget Office report uses more realistic assumptions and suggests that by 2013, "the government is likely to be spending more on interest on the debt than on all domestic appropriations put together - from education, to the environment, to law enforcement, to science, to transportation, to veterans."

Under the Congressional Budget Office assumptions, the national debt, including what's owed to Social Security (excess Social Security revenues are lent to the federal budget), will triple by 2015, to $14.8 trillion, some $10 trillion more than the debt when President Bill Clinton left office.

State Debt, Public Authorities, and Budget Gaps

Governor George Pataki has his own method of avoiding structural budget balance. According to the Hevesi report, since 2000 the state has borrowed $7.7 billion to pay for state, city, and school district operating expenses. That includes $4.6 billion borrowed from a tobacco-settlement fund. Such debt generally is paid off over a 30-year period, at least doubling the total cost of the debt. In addition, the state authorized $2.8 billion in debt for legislators' program initiatives and local economic development for fiscal years from 1997 through 2005.

State-funded debt now is approximately $47 billion. That represents $2,420 per New Yorker statewide, more than two and one-half times the national average of $944. (New York City's own $50 billion debt, as noted in last month's Finance topic page article, is over $6,200 per city resident. So, total governmental debt burden for city residents now stands at more than $8,600 per person.)

Another problem with the state debt is that some 92 percent of the $47 billion was authorized through public authorities. Essentially controlled by the governor, these authority debt decisions bypass any democratic approval process. Hevesi calls this "backdoor borrowing." A Newsday articlesuggests that such off-budget techniques remain alive and well: the governor is now considering selling such state resources as the New York State Thruway and the Tappan Zee Bridge for cash to help balance the state budget.

Hevesi's report recounts the state's most outrageous example of shuffling state resources to fill an operating budget deficit at great long-term cost. In 1990 the state, under Governor Mario Cuomo, "sold" Attica prison to the state's Urban Development Corporation (now the Empire State Development Corporation).

The state, in other words, sold the prison to itself. That raised $200 million of cash to help one year's budget deficit, but since 1990 the state has paid $242 million in debt service on that deal. And because of refinancing the "appalling" debt, the state still owes $323 million in principal and interest. So the total cost for the $200 million one-shot revenue will be at least $565 million.

Hevesi notes the link between state debt and the state budget: "The State's practice of paying for recurring operating expenses with one-time funding sources exacerbates structural instability and feeds annual budget gaps along with the State's chronically poor credit rating."

Structural Balance Ignored Again

A common theme in these accounts is that president, governor and mayor all refuse to use their revenue powers to stabilize their financial plans. For both President Bush and Governor Pataki, tax cuts are long-term ideological positions. For Mayor Bloomberg, tax cuts are an election-year strategy, in spite of huge revenue losses: $250 million in property tax rebates and over $600 million in the phasing out of personal income taxes paid by the city's highest-income residents.

The mayor complains about his lack of discretion in budget decisions. Rapidly increasing Medicaid, pension, and debt service costs, indeed, are mostly beyond his control. But the mayor is disingenuous; he has huge discretion on the revenue side. (The mayor's most stabilizing budget move, after all, was his bold $3.7 billion tax-package back in 2002/2003).

The problem is that mayors like Bloomberg and his predecessor, Rudy Giuliani, have little or no interest in "structurally balanced budgets" - that is, budgets that at any moment are balanced over several years. They essentially say: Let's take it a year at a time. Trust us.

For more than a dozen years, fiscal monitors have set a goal of "structural balance" for the city. Every year they get the fiscal back of the hand. Most recently, the December 2004 Financial Control Board report on the mayor's October 2004 budget modification(In PDF format) says, "The budget gaps projected for FY 2006 and beyond are illustrations that the city's finances remain structurally unbalanced."

This year's adopted budget was mostly balanced by using the (one-shot) $1.9 billion surplus - a kind of sunny-day fund -- from the previous year's budget. With this year's surplus at $1.4 billion and counting, next year's adopted budget will apparently go the same route. That may work well enough for an election year, but it will leave next year's mayor with the same old problem, a structurally unbalanced financial plan at the mercy of the economy.

Glenn Pasanen, former associate director of City Project, teaches political science at Lehman College of the City University.

Facing Unemployment

In the months after September 11, thousands of New Yorkers lined up at job expos when the city's unemployment rate peaked at 8.3 percent. Today, the unemployment rate is down, however the total number of jobs and the size of the city's labor force have also decreased. Related in Community Gazettes: Saving Industrial Jobs in Bathgate |

Since she lost her job at CVS pharmacy in May 2003, Marlene Perez has interviewed for jobs at over a dozen other retail stores. She has spent months shuttling to and from the New York State Department of Labor, trying to collect unemployment insurance.

Perez has had no luck in getting either employment or unemployment benefits, which may be why she is not a big fan of Mayor Michael Bloomberg and his upbeat declarations about the city's economy.

"Every time he comes on that TV, I flip the channel," she said. "I don't want to hear it."

Perez, a 40-year old native New Yorker, is one of 230,000 unemployed New York City residents. She is not alone in questioning the official optimism about the unemployment problem. How effective, critics ask, are the city's job training programs? How fair are New York's policies on unemployment benefits? What will the plans and programs for "job creation" really create? But the debate begins with something even more basic: What is the real picture of unemployment in the city?

NEW YORK CITY'S UNEMPLOYMENT PICTURE

"We've come back strong - and we're creating jobs and opportunity in all five boroughs," Mayor Bloomberg proclaimed in his state of the city address last month. "Today the unemployment rate is down to 5.4 percent. For the first time in 16 years, New York City's unemployment rate is as low as the entire nation's."

New York City Councilmember Charles Barron, who is a candidate for mayor, was not the only person to react skeptically, but his response was among the more succinct: "He painted a rosy picture," he said, "of a city that I'm trying to find."

The skepticism begins with the unemployment rate itself. There is no question that the city's unemployment rate has declined recently, from a spike after 9/11 that reached a peak of 8.3 percent. But those who monitor the city's economy put little faith in this monthly statistic issued by the U.S. Department of Labor. "It's a meaningful measure of several things," Daniel Okrent wrote recently in the New York Times, "but not of what you and I mean by unemployment.'"

That is because the official unemployment rate does not include those people who have given up looking for work. In fact, in recent months, the total number of jobs in the city has actually declined, and the size of the city's labor force - those people either employed or looking for work - decreased between 2000 and 2003 by 11,000 people.

The official unemployment rate also does not take into account people who are "underemployed" - those who work only part-time or whose jobs do not provide them with adequate pay, security or benefits. Over the past year, the number of New Yorkers working as temps has increased, the temp agency industry having grown by more than eight percent.

Worse, say some critics, is the inequality of opportunity. New Yorkers are more likely to be jobless if they are male than if female, if they are in blue-collar occupations than white-collar, and if they are black or Hispanic than if they are white. Young people in New York City are less likely than those the rest of the country to have a job.

In an oft-quoted study, the Community Service Society found that barely one-half of African American males worked in 2003, as opposed to 75 percent of while males (report in pdf format). This disparity is due in part to a lack of credentials and experience among black men, says the study's author, Mark Levitan, and in part to discrimination.

Optimists argue that, in keeping with the usual up and down pattern of the business cycle, the unemployment picture in the city will improve as the economy improves. But others point to signs that something this time is different: For more than two years now, over 20 percent of the workforce has been unemployed for at least six months, which is the longest such streak since records started being kept in the 1960s.

Nationwide, millions of the unemployed are exhausting their unemployment benefits, the government-funded cushion intended to aid them while they look for work. In New York, unemployment benefits range up to $405 a week and last for 26 weeks. In recessionary times, the federal government can provide the funds to extend this, though it did not do so the last time it could have.

But many people are getting no benefits in the first place, a problem that is particularly widespread in New York.

UNEMPLOYMENT BENEFITS

Only 42 percent of unemployed residents of New York State collected unemployment insurance in 2003, a far smaller percentage than other states in the region, according to the National Unemployment Law Project.

Low-income residents of New York City collect at even lower rates. A 2002 study by the Brennan Center found that New York City residents who lost jobs paying over $22.46 an hour were more than twice as likely to receive benefits than those whose previous jobs had paid less than $8 hourly, regardless of education (in pdf format). It attributed the discrepancy to low-wage workers not believing that they were eligible for benefits.

Andrew Elmore, a Legal Aid attorney adds that low-wage workers — especially those who aren't completely comfortable with English –are less likely to be able to navigate the state's bureaucracy. He believes this problem will get worse as the state does more and more of its business over the phone and the Internet, as opposed to in person.

"For upper income and middle income English speakers, this is probably a good thing, because you don't have to physically wait online to apply and claim for benefits," he said. "The problem is really for low income workers, especially those who are low English proficient."

Elmore spends much of his time trying to prevent employers from blocking their former workers from collecting benefits, in hearings at the state's Department of Labor. He represented Perez when CVS challenged her unemployment claim. The company said that Perez had been fired for violating a store policy. Perez says that this is what she was told when she was let go by a new manager, but that she had simply been following the rules as taught to her by her previous boss. After a hearing in which two managers testified against her and a co-worker and a supervisor testified on her behalf, Perez's claim was rejected. She appealed, a process that lasted six months but ultimately ended in the same result.

"I don't know why they are trying to fight me," said Perez, whose failure to get employment benefits convinced her husband not even to file for them when he lost his job.

The reason they fight is that employers' tax rates are based on how many former employees qualify for unemployment. This has been part of the unemployment insurance system since its inception in 1930s. It was intended to discourage companies from laying off workers, but it also creates an incentive for employers to challenge claims.

"Unemployment insurance is not a welfare system," said David Raff, a labor law attorney. "You have to be unemployed through no fault of your own, and no fault of your own is an elastic concept."

If some see an inherent injustice in a process that pits well-prepared companies against overmatched individuals, critics have long labeled New York's system as especially unfair. Raff monitors the state's performance, a responsibility he took on after his firm successfully sued the state for the system's lack of due process.

The procedural violations continue, Raff says, including a lack of translation services, and a failure to allow the presentation of evidence and the cross-examination of witnesses. Much of this, he says, is the result of insufficient funding, which limits many cases to hearings of a half hour or less.

JOB TRAINING

Philip Botwinick lost his job working on computers for financial firms shortly after September 11. Since then he has worked as a driver for a car service, for WBAI radio, helping friends on remodeling projects, and during November's presidential election as a poll worker near his home in Queens. None of these jobs have offered steady, full-time work.

Botwinick also received benefits for workers displaced by 9/11. His benefits included a stipend to take classes in newer computer languages.

"I wasn't happy with the courses I got," he said. He said the classes didn't teach him much, and wondered if they were practical. "I don't even know if technology is worth going into. From what I'm reading, all of the jobs are in the service industry or restaurants."

For as long as the city has run job-training programs, the lack of connection to the real-life working world has been a common complaint. The more effective programs have been offered by private employers or by unions, whose apprenticeship programs have long been considered one of the best ways to get workers who do not have high levels of education into steady, well-paying jobs.

City College of New York has also become increasingly effective in providing job training, according to a report by the Center for an Urban Future (report in pdf format). In total, a quarter of a million people are involved in some sort of practical job training, the report found; 25,000 were in programs where the university had partnered directly with private employers to provide training.

Conceding that the city's operations needed to be more responsive to the current job market, the Bloomberg administration folded the Department of Employment into the Department of Small Business Services in the summer of 2003 and the following April opened job-training centers called Workforce 1 Career Centers across the city.

"The big strategic imperative was how do you make sure that when you're training people, it's connected to real work at the end of the day," said David Margalit, deputy commissioner of workforce development for the department.

Pablo Acosta, a Dominican-born resident of Gun Hill in the Bronx, had been unemployed for about a month when he started attending bank teller classes at one of the centers. After a three-week training period, Acosta quickly found a job with HSBC.

"It might have been the lowest position at the time. But it was a great opportunity to learn from the bottom and work yourself up," said the 25-year old Acosta, who had previously worked in retail, a job he found too taxing. "They had connection with the banks … and put you into new and different ones until you found one."

While comprehensive statistics are not yet available on the program's success, some who have been skeptical of the city's job training in the past say they are modestly encouraged. But, they say, it is not enough.

"I believe in training, but we get stuck in training," said Councilmember Barron. "It has to be coupled with serious job placement -- and serious job creation."

JOB CREATION

When the members of the City Council heard of the report on unemployed black men, they allocated $10 million to create new jobs. But how to do it? Should they subsidize wages, or create business incentives, or directly help local entrepreneurs? All these ideas have been discussed. The money so far remains unspent.

Nobody is against job creation, but public officials seem unsure how to do it. Steve Malanga of the Manhattan Institute thinks that the government should concentrate on making the city attractive to businesses, "with reasonable tax rates, effective schools, and low crime rates." The Bloomberg administration's pitch for its ambitious development projects includes an argument that it will create many new jobs. Bloomberg contends that the Hudson Yards development alone will create 280,000 new jobs, largely in the tourism industry. Critics counter that, even if this number is for real, it might not make sense to focus on a low-wage industry that has traditionally hired few minority men. They believe there should be targeted encouragement of specific industries that have potential to create sustainable jobs for the populations that need them most.

Last month the administration announced several new steps to support manufacturing and keep manufacturing jobs in the city. The mayor’s plan (in pdf format) would create 14 Industrial Business Zones. These areas could not be rezoned for residential use, which are often more profitable. Tax credits would be available to businesses that moved to the zones, and the city would also help provide job training and improve sanitation in the area. The new Office of Industrial and Manufacturing Businesses, will oversee the Industrial Business Zones. (See related story.)

Public officials and economic observers generally agree that the construction industry holds the greatest promise in the near future, for several reasons. First, with the number of housing permits up 20 percent since 2000 and increased commercial development anticipated at Ground Zero and on Manhattan's Far West Side, there will be plenty of construction work to do. Second, the jobs are well-paying union positions. Third, the impending retirement of baby boomers, the last generation to move into skilled trades, is expected to create many openings in the coming years.

Fourth, those jobs might finally be opened to women and people of color. Bloomberg recently announced that his administration will focus on the construction industry, promising programs (with names like "Building Jobs Through Building New York") that would encourage the hiring of minorities, especially through minority-owned and women-owned businesses. This might have been a pre-emptive strike against a City Council report published soon afterward that found the city is failing to contract with such businesses now. (in pdf format) But the promise leaves some observers feeling hopeful. "I think that the good will is genuine on the part of the people from the employer side and from the union side" said David Fischer from Center for an Urban Future. "That is really all you need to make what the mayor was talking about work."

In the meantime, Marlene Perez looks for work without help from the city – partly because of her unhappy experience trying to get benefits and partly because she wants to be independent. Her husband David's military pension and his job at the Columbia Presbyterian Hospital pay the bills; her 20-year-old son David, who works as an electrician, helps her buy things for his 16-year-old brother, Christian, when he can be convinced not to spend the money on his girlfriend instead.

Perez has thought about switching from retail - maybe to work with children - but she is hesitant to leave a profession she feels comfortable with. Her most recent interview with Rite-Aid pharmacy went well, she thinks. She's still waiting to hear back.

FROM GOTHAM GAZETTE

• The Mayor's State of the City Address

• Mayor's Rivals Respond to the State of the City

• What is the State of the City?

• In Big Projects, Where do the Jobs Go?

• The Lie of Prosperity

• Creating Jobs, and Filling Them

NEW YORK'S UNEMPLOYMENT PICTURE

• National Employment Situation Summary (by the Bureau of Labor Statistics)

• New York City Unemployment for December, 2004 (by the City Comptroller)

• Companies Increasingly Relying on Temp Agency Workers (by the National Employment Law Project)

• A Crisis of Black Male Employment: Unemployment and Joblessness in New York City (in pdf format by the Community Service Society)

• Black Male Unemployment in NYC, 2004 (by the Center for an Urban Future)

• New York City's Disconnected Youth (in pdf format by the Community Service Society

• Why are New Yorkers' Incomes Staying Steady When So Many Are Unemployed (by City Limits)

• Women and Minorities not Getting Their Fair Share of City Contracts (in pdf format by the New York City Council)

UNEMPLOYMENT INSURANCE

• Unemployment Compensation (by the Almanac of Policy Issues)

• What is Unemployment Insurance (by the New York State Department of Labor)

• Unemployment Insurance (a series of articles by the Center of Budget and Policy Priorities)

• Improving NewYork State's Unemployment Insurance System (by the National Employment Law Project)

• State by State Comparison of Unemployment Benefits (by the US Department of Labor)

JOB TRAINING AND CREATION

• CUNY on the Job (by Center for an Urban Future)

• Workforce One Career Centers (by New York City Department of Small Business Services)

• New York City's Unemployment Crisis and the Need for an Emergency Job Creation Program (by James Parrott of the Fiscal Policy Institute)

The 2006 New York City Budget

|

Mayor Ed Koch saw a "rosy glow on the horizon" and proposed hiring 10,000 new city employees.

Mayor David Dinkins found money to put more cops on the street, extend library hours, and expand school health programs.

Mayor Rudolph Giuliani gave teachers a huge raise, handed out multiple tax cuts, and declared, "We have changed the direction of the city."

Each of these mayors was proposing a budget in a year (1985, 1993, and 1997 respectively) when he was running for reelection.

So in this election year, it was not surprising when Republican Mayor Michael Bloomberg's $48.3 billion budget played up the good news, downplayed the bad news, and blamed the $3 billion deficit on Albany.

Two years ago in his budget presentation, Bloomberg was upfront about closing six firehouses. In this year's presentation, he neglected to mention that his new budget cut staff at 49 firehouses. And if it wasn't clear from this that his budget address was also a campaign speech, the mayor said, "Now is not the time to change course."

But campaign season is also time for the mayor's critics and opponents to warn New Yorkers that election year budgets are often followed by post-election budget problems.

|

WHAT'S IN THE MAYOR'S BUDGET?

The Good News

In contrast to his three previous budget plans, the mayor did not offer a "doomsday scenario" for what might happen if he did not get his way: He did not threaten to close zoos or shut firehouses or cut back on trash pickups.

In large part, that is because the city's economy is showing signs of recovery.

Tax revenues are back to pre September 11, 2001 levels. Wall Street profits - which account for about one-third of the city's tax revenues - are up. Commercial and residential real estate are strong. And tourism is at record levels.

"We are in better shape today than we were a year ago," the mayor said. "My message is one of cautious optimism."

But some argue the mayor is relying too much on a good economy.

"You can't just say we are going to grow our economy out of these problems," said Republican Councilmember James Oddo. "What will happen is that when Wall Street goes in the tank, which it does from time to time, there will be two choices: close every firehouse in the city or raise taxes."

The Deficit

Despite the good news, the city's budget has a structural imbalance: Year after year, expenses continue to be higher than tax revenues.

In 2006, the city expects to have a $3 billion deficit.

In order to close the gap, the mayor plans to:

- Use a $1.4 billion surplus from this year to fill the gap in next year's budget.

- Cut $600 million from the city's current programs.

- Receive $500 million in aid from the state government in Albany.

- Receive $250 million in aid from the federal government in Washington.

- Save $325 million in changes to pension and health insurance.

The mayor argues the deficit is not entirely his fault and that the amount of money the city spends on services like police, firefighters, and sanitation has only increased about six percent over the last five years.

The most significant problem, Bloomberg argues, is with so-called "non-discretionary" expenses - things like Medicaid payments, pensions and benefits for city workers, and payments on debt from past - that the city cannot control.

The cost of these four items now total more than $20 billion a year, almost 40 percent of the city's entire budget. As a result, the city faces another estimated $4.4 billion deficit in 2007.

"The city is no longer in control of its biggest expenses," the mayor said.

Some criticize the mayor for not doing more to deal with these issues.

"So are we heading for two-thirds or three-quarters of the budget being out of the mayor's control?" said Diana Fortuna of the Citizens Budget Commission. "You have to start to attack the source and get cooperation from Albany, which is never an easy thing, and cooperation from labor unions."

The Cuts

The mayor's plan calls for nearly $600 million less money for city agencies that deliver the services that New Yorkers depend on everyday, but he refused to call them "cuts."

"We are not cutting programs," Bloomberg said. "We are doing more with less."

However, the City Council argues that they are cuts and that they will be painful for New Yorkers.

The mayor's cuts include:

- Reducing staff at 49 firehouses

- Shorter library hours

- Cutting $15 million from after-school programs

- Eliminating some hot meals to homebound senior citizens.

The City Council's biggest criticism of the mayor is with his capital budget, which proposes cutting $1.3 billion from school construction over the next five years.

"We are talking about libraries, science labs, playgrounds, and bathroom repairs," said Councilmember Eva Moskowitz, who chairs the council's education committee. "The `Education Mayor' is clearly not putting children first."

Tax Rebate

Despite the deficit and budget cuts, the mayor is planning on again giving out a $400 property tax rebate to each owner of a co-op, condo, or private house who had to pay the 18.5 percent property tax increase imposed in 2002. Business owners and landlords of large buildings would not be eligible.

The tax rebate will cost the city about $250 million. The mayor said he would likely give out the tax rebate again next year as well.

City Council Speaker Gifford Miller, who fought the mayor on the tax rebate last year, but eventually accepted the idea, said it was "too early to tell" if the $400 rebate makes sense. "We need to look at it in the context of the whole budget," he said.

Since the city does not have the power to raise or lower taxes (with the exception of property taxes), Mayor Bloomberg is also lobbying Albany for some changes in when certain taxes will expire.

Governor George Pataki has proposed ending the personal income tax surcharge - a state tax on the top two income brackets - retroactively to December 31, 2004, which the mayor opposes.

Two years ago, the state reinstated taxes on clothing and shoes that cost less than $110. That sales tax is also set to expire this summer, which the mayor supports.

|

WHAT THE CITY WANTS FROM ALBANY

Mayor Bloomberg's budget assumes that the State Legislature in Albany will give the city $500 million.

"We send $11 billion more to Albany in tax revenue than we get back," the mayor said, "So I think asking for $500 million is reasonable."

One of the biggest priorities is Medicaid reform. Unlike most other states, New York requires local governments to pay a major portion of the Medicaid bill. New York City's costs have risen dramatically in recent years, and will cost the city nearly $5 billion in 2006.

If the state enacted the Medicaid reforms the city is asking for, it could save the $425 million next year.

The city has also assembled a long list of other ways the state could help, including:

- Repealing the Wicks Law, which requires the city to hire multiple subcontractors for building projects (which the city calculates is worth $451 million)

- Reforming Social Security reimbursements (worth $130 million)

- Allocating funds to upgrade voting systems (worth $92 million)

- Enacting tort reform (worth $83 million)

- Giving the city permission to use red-light cameras (worth $13 million).

In addition, the mayor is fighting a series of proposals in the governor's budget that would increase tuition at the City University of New York, delay funding for Family Health-Plus programs, and provide $2 billion less for mass transit projects than the Metropolitan Transportation Authority has requested.

City Council Speaker Gifford Miller said the mayor must try a new approach if he wants to get real results from Albany.

"He keeps going back to the same playbook and we keep getting the same results," said Miller. "We need to get tougher and to fight harder."

|

WHAT THE CITY WANTS FROM WASHINGTON

The city is also asking the federal government for $250 million in aid in order to balance its budget.