Gov. Hochul talks budget (photo: Darren McGee/Office of Governor Kathy Hochul)

The Federal Reserve Board’s aggressive interest rate increases have put the nation and New York on notice that an economic downturn is a serious possibility. The Board is determined to wring inflation out of the economy, and forecasts higher unemployment but no recession. Nonetheless, New York’s leaders need to brace for one.

The nation has suffered through two vastly different recessions in the past 14 years. The COVID-19 pandemic is fresh in our memories; the Great Recession of 2008-2009 was not an economic lockdown brought on by a deadly disease, but a financial and industrial meltdown followed by a slow recovery.

In 2008 I was still in the New York State Assembly and had a bird’s eye view of New York’s escalating financial problems and our struggles to cope with them. This time around it looks like the State is far better prepared than it was then, when the State had virtually no reserves. By contrast, New York City seems less well prepared than in 2008, when it had much higher financial reserves, but its property tax base may give it the stability it needs to ride out a recession.

I wish someone would tell the Federal Reserve to stop raising interest rates and let what it has already done cool the economy rather than risk a recession, but it doesn’t look like the hawks at the Fed would listen. So what should New York do to prepare?

New York State: The First Year of Covid

New York became the nation’s epicenter of the COVID-19 pandemic in March 2020. By the beginning of June 2020 about 30,000 New Yorkers had died of the disease. Between February 2020 and April 2020 New York State lost 1.9 million jobs, 20% of its overall employment and 23% of its private-sector employment, compared to 14% and 16% nationally, respectively.

The state government, anticipating a giant recession, adopted a budget plan in April 2020 allowing the Governor to cut up to $10 billion from the state budget and permitted New York to borrow unprecedented sums of money if necessary. A few days before the state adopted its budget, then-President Trump signed the $2 trillion CARES Act intended to preserve the economy primarily through direct relief to individuals and businesses. Then-Governor Cuomo and other leaders pressed the federal government until December 2020 to add more relief for state and local governments.

On December 27, 2020, Trump and Congress enacted a new $900 billion stimulus package, adding relief for individuals and businesses but also adding support for state and local governments, especially for education.

By March 2021, it became clear that predictions about staggering tax revenue losses in New York in 2020 turned out to be wrong. New York’s tax revenues for the 2020-21 fiscal year barely declined at all, from $82.9 billion to $82.4 billion, although the State had recovered only about 1 million of the 1.9 million jobs it lost during the lockdown.

The State’s Tax Base

It turned out New York State could have big job losses but not lose tax revenue because of its tax base. New York State obtains 60% of its revenue from the income tax.

Even as the pandemic wreaked havoc among sectors of the economy like leisure, hospitality, and retail, jobs in the affluent office sector, like finance, technology, and business services, did not suffer large declines. The office sector workforce was for the most part able to work remotely, and some still paid hefty bonuses while the wealthy continued to pay taxes on capital gains income from the stock and real estate markets. Those high incomes sustained high tax revenues even while more than a million people had lost their jobs.

The New York State income tax base is pictured in this year’s budget and shows the concentration of income and tax liability for the years 2007, 2009, and 2019, the bookends of the Great Recession and the year immediately prior to COVID, which is the last information available.

Looking at 2019 makes it clear how 2020 finances took the path they did, as well as the path the state’s finances took in the Great Recession:

The data show the extraordinary concentration of income and income tax liability in New York. In 2019, the top 1% had 29% of New York’s adjusted gross income and 50% of its non-wage income, and paid 42% of its income taxes. The top 10% had 57% of the income and 69% of the non-wage income, and paid 72% of the income taxes.

Low and middle-income residents are surely paying plenty of taxes in comparison to the levels of their incomes; when you add sales, property, social security, and income taxes together on the incomes of the middle and working classes, they are paying plenty. But the data can explain how even as one portion of the workforce is experiencing great pain, the state’s income tax revenue can hold up from another portion without job and income losses. It also shows what can happen from a recession connected to a financial meltdown, such as what occurred in the Great Recession.

The New York Budget and The Great Recession

In the adopted state budget of 2009-2010, New York closed a $20 billion deficit, $2.2 billion from 2008-9, and $17.9 billion for 2009-10.

Governor Paterson’s press release from the time of budget adoption described how the state balanced its budget: $6 billion in spending cuts; $5 billion in tax increases (mostly on the wealthy); and $6 billion in federal aid. The state had little reserves; they were a minimal factor in balancing the budget.

The Concentration of Income and Liability table above shows how a financial meltdown can affect the budget. New York’s adjusted gross income falls 17% over the two-year period (from $631 to $520 billion), non-wage income falls 38% ($270 to $167 billion), while wage income falls less than 3% ($412 to $401 billion). The crash in non-wage income is primarily the drop in capital gains. Tax payments fall, while deficits explode, because governments build budgets based on projections that plan for increased revenues and increased spending.

The Covid Recovery: Tax Revenue Rockets Up

President Biden signed the $1.9 trillion American Rescue Plan into law on March 11, 2021. The plan included stimulus payments, state and local government financial support over several years, including a tranche of 2023 support, additional education funds, vaccine distribution funds, and other health care support.

According to the U.S. Bureau of Labor Statistics, the nation has gained 8.3 million jobs since March 2021, from 144.4 million to 152.7 million. According to the New York State Labor Department, New York State has gained 596,000 jobs, from 8.919 million to 9.515 million, with New York City accounting for 406,000 jobs, rising from 4.147 million to 4.553 million.

New York’s healthy economic growth, driven by the American Rescue plan, job increases, the boom in the stock market, Wall Street profits and bonuses, and a tax increase on the wealthy and large business enacted by the Legislature in April 2021, resulted in the state’s tax revenue taking off like a rocket.

From April 1, 2021, to March 31, 2022 (NYS Fiscal Year 2022), the state’s tax receipts grew an astonishing $22 billion, or 27%. The Governor and the Legislature responded with largess for the budget year that began in April 2022. There was a 7% school aid increase, $2 billion to backfill unpaid rent and utility bills from the pandemic, more than $1 billion for bonuses for health care workers, major funding for child care expansion, $2.5 billion in property tax relief, and gas tax relief. The State Division of Budget plan projected surpluses this year and for the next several years, and the state made a significant deposit into reserves.

New York Flush with Cash, Didn’t Spend It All

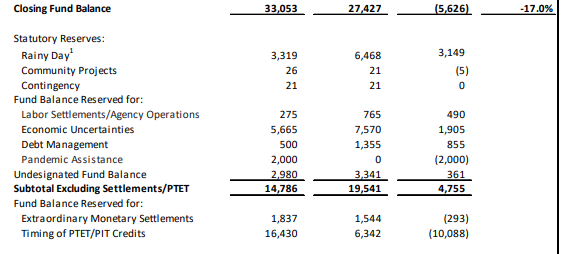

The State Budget Director, Robert Mujica, who worked for Governor Cuomo and was retained by Governor Hochul, must have had the Great Recession in mind when planning for the state FY2023 budget. The Legislature was persuaded to save billions from the surplus cash that flowed into the State Treasury in 2021. As of this July, the state was so flush that it anticipated having a cash balance of $27 billion in the General Fund by March 2023, of which $19.5 billion could be accessible for an emergency, excluding special obligations. See NYSDOB, 1st Qtr. Update, p.25:

FY’22 FY’23

A New Recession in New York May Be Like 2008-09

The Federal Reserve’s hawkish actions to curb inflation upended the Division of the Budget’s rosy projections within just a few months. The State DOB’s First Quarterly Update (April-June 2022) recognized the Federal Reserve’s actions to slow the economy would halt the revenue boom. Surpluses would turn to deficits and next year, FY 2024, would see a $3 billion deficit. Deficits in future years would grow. The update was written in August, before the Federal Reserve’s next big interest rate increase, and the DOB will surely increase the size of the state’s deficits next year and beyond due to the slowing economy.

Big stock market declines, plunging Wall Street bonuses, and a drop in real estate transactions mean big tax revenue losses even if job losses are modest because the wealthy already pay such a large share of New York’s taxes. Even in a recession, they stay wealthy, their incomes just decline temporarily. But that’s why a recession in New York could be similar to 2008-2009. This time New York is fortunate all that cash is sitting in reserve funds.The state will need the reserves to mitigate the economic impact of the downturn and preserve services, especially if there are no new federal funds for another bailout of state and local government.

What To Do

-Substitute Borrowing for Use of Cash in Capital Projects

The state plans to transfer $4 billion in cash in 2023 and $6 billion in 2024 to avoid selling long-term bonds to pay for capital projects, a large increase in the use of cash for capital projects compared to past years. This is prudent but the state doesn’t have to do this. It is discretionary.

The cash could be used to support the operating budget if necessary during a recession. Borrowing several billion is not a bad thing, capital projects are appropriate uses of borrowed funds. The state could also defer certain capital projects to preserve cash.

The state also has the ability to borrow short-term for operating purposes, as long as the money is repaid by the end of the fiscal year. If necessary, the state could borrow several billion next spring to cushion spending as the economy is monitored. It could use its reserves to repay the money at the end of the year.

-Use the Reserves, That’s Why They’re There

The State has enough flexibility to use $5 billion a year, even for more than one year, to protect services. Obviously it would be unwise to use all of the reserves.

-Use Federal Aid from the American Rescue Plan

A third and fourth year of federal support for state and local government provides $2.4 billion in 2024 and $2.3 billion in 2025. The state can use these funds as it wishes, including simply shoring up its existing budget.

-Postpone, Even Modestly, Planned Spending Increases

The state cannot really hide completely from a downturn that results in lower revenues. It has planned a $3 billion (10%) increase in school aid in 2024 to strengthen Foundation Aid. It can stretch that out further. The state’s child care expansion is only $100 million extra in 2024 and that should be sustained; it is not very costly.

New York City and Recession

New York City has now recovered 85% of the jobs lost during the lockdown, not as high as the nation, but it lost 23% of its employment in the lockdown, compared to 14% nationally so it has had much further to go to recover. It would be a shame if Federal Reserve actions thwart the city’s recovery.

The healthy recovery enabled the city to use $6 billion in surpluses to prepay expenses for this fiscal year, which began July 1. However, federal aid this year (FY 2023) has dropped closer to normal, $9 billion. As a result, surplus cash is likely to be unavailable next year and the projection is that the city will have a $4 billion deficit. This was the projection at budget time before the Federal Reserve Board’s aggressive actions.

State Comptroller DiNapoli’s August 2022 report on New York City’s Financial Plan warned that risks to the city’s budget could increase the city’s deficit next year to $6 billion (some of which appears to be an unavoidable pension shortfall of $870 million).

The comptroller’s report indicated that a recession similar to 2009 could result in $4 billion in revenue losses to the city next year. Both the comptroller and the Citizens Budget Commission have been urging the city to build its reserves, which are lower proportionately than what the city had available in 2009. Mayor Adams is implementing a Program to Eliminate the Gap (PEG), curtailing spending now across city agencies.

The city’s newest fiscal challenges, from Texas sending refugees to the state mandating class size reductions for the school system, call out for state and federal help, especially given the risk of a recession. The city has one backbone for revenue: the property tax, which historically has held up even in downturns.

The city has $8 billion in reserves and, as a last resort, could enact a highly unpopular property tax increase. The city needs to maintain, even increase, its capital program and invest even more funds in affordable housing and conversion of office space to residential. During the next state budget process, Mayor Adams will need a truly focused effort to get the state to acknowledge the need to help its largest city.

In the Great Recession, the breakdown of the state budget lasted three years, from 2008-2011, in major part because it had no reserves to fall back on. This time, the state may be able to manage a soft landing in New York, even while the rest of the country has more problems than we do.

***

Jim Brennan was a member of the New York State Assembly for 32 years, where he chaired four committees. On Twitter @JimBrennanNY.

***

Have an op-ed idea or submission for Gotham Gazette? Email This email address is being protected from spambots. You need JavaScript enabled to view it.